Stamps.com Reports Second Quarter 2016 Results

EL SEGUNDO, CA — (Marketwired) — 07/28/16 — Stamps.com ®(NASDAQ: STMP), the leading provider of postage online and shipping software solutions to approximately 650,000 customers, today announced results for the second quarter ended June 30, 2016.

Second Quarter 2016 Financial Highlights

- Stamps.com acquired ShippingEasy, a leading web-based multi-carrier shipping software platform that allows online retailers and e‑commerce merchants to organize, process, fulfill and ship their orders quickly and easily. The Company’s second quarter financial results do not include the results of ShippingEasy as the transaction closed on July 1, 2016.

- Total revenue was $84.0 million, up 74% compared to the second quarter of 2015.

- GAAP net income per fully diluted share was $0.79 compared to a loss of $0.64 for the second quarter of 2015.

- Non‑GAAP adjusted income per fully diluted share was $1.94, up 100% compared to $0.97 in the second quarter of 2015.

- Adjusted EBITDA was $38.2 million, up 116% compared to the second quarter of 2015.

“The acquisition of ShippingEasy will further accelerate Stamps.com’s ongoing investments in shipping technology for e‑commerce driven package shipping, the fastest growing segment within the mailing and shipping space,” said Ken McBride, Stamps.com’s chairman and CEO. “Our investments across all our companies in the areas of sales and marketing, customer service, product development and technology innovation have led to growth in packages shipped by our customers, which in turn have contributed to our great financial performance. Based on our outstanding results and the continued strength in our businesses, we increased our 2016 guidance today.”

Second Quarter 2016 Detailed Results

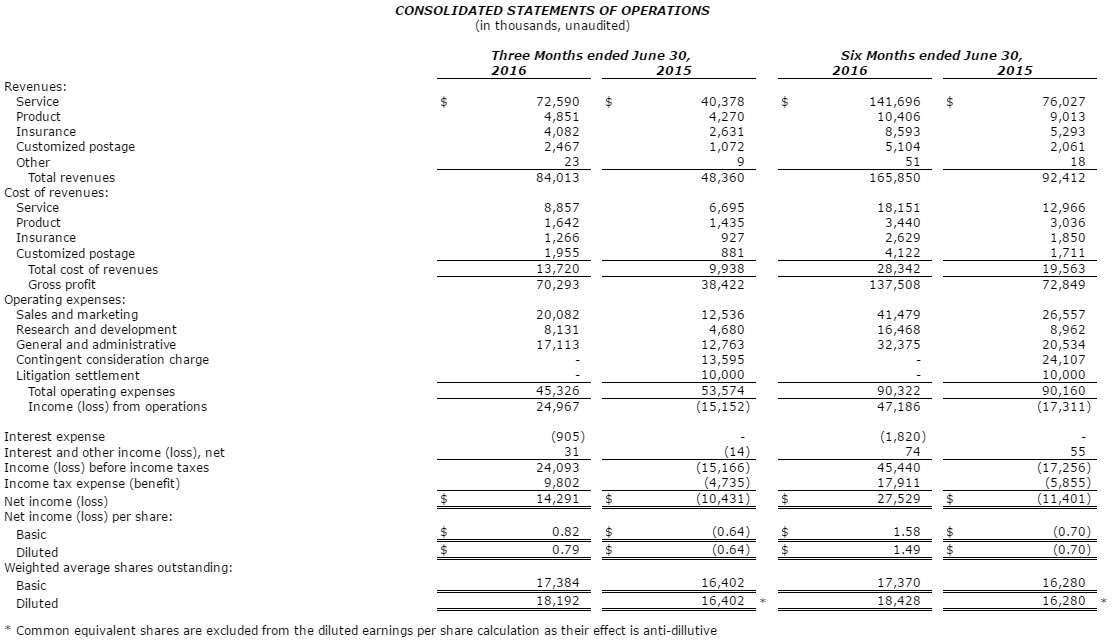

Total revenue was $84.0 million, up 74% compared to the second quarter of 2015. Mailing and Shipping revenue (which includes service, product and insurance revenue but excludes Customized Postage revenue) was $81.5 million, up 72% versus the second quarter of 2015. Customized Postage revenue was $2.5 million, up 130% versus the second quarter of 2015.

GAAP gross profit, which includes $0.45 million of stock-based compensation expense, was $70.3 million and GAAP gross margin was 83.7%. Excluding stock-based compensation expense, Non‑GAAP gross profit was $70.7 million and Non‑GAAP gross margin was 84.2%.

Second quarter 2016 GAAP income from operations was $25.0 million and GAAP net income was $14.3 million. GAAP net income per share was $0.79 based on 18.2 million fully diluted shares outstanding. This compares to second quarter 2015 GAAP loss from operations of $15.2 million and GAAP net loss of $10.4 million or $0.64 per share based on basic shares outstanding of 16.4 million. Basic shares outstanding were used for the 2015 period because the effect of common equivalent shares would have been antidilutive given the net loss.

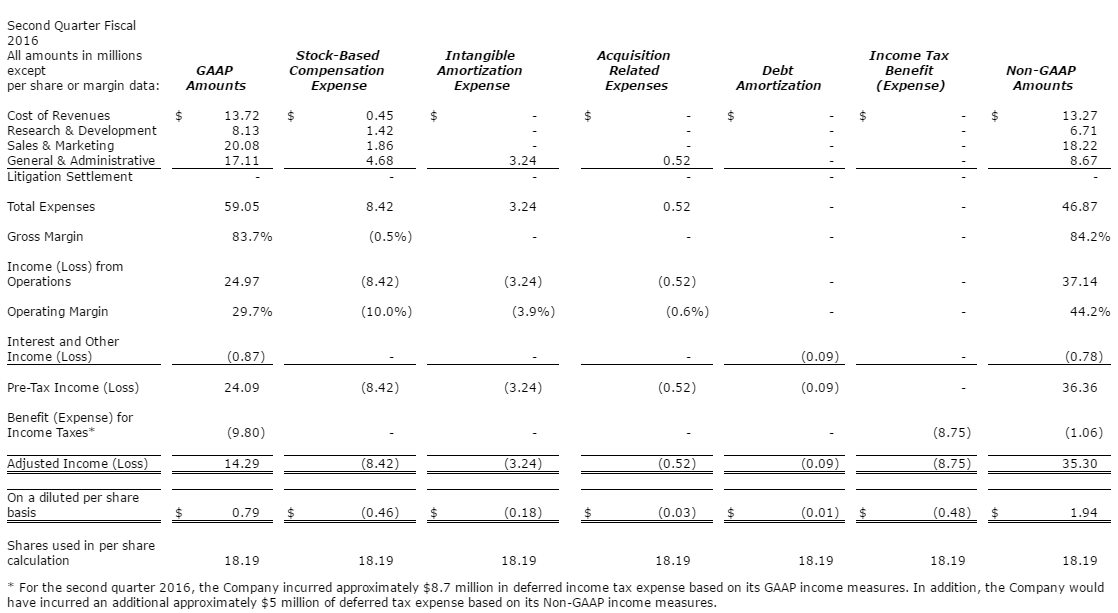

Second quarter 2016 GAAP income from operations included $8.4 million of non‑cash stock-based compensation expense, $3.2 million of non‑cash intangible amortization expense and $0.5 million of transaction expenses related to the Shipping Easy acquisition. Second quarter 2016 GAAP net income also included $93 thousand of non‑cash amortization of capitalized debt issuance costs and $8.7 million of non‑cash income tax expense.

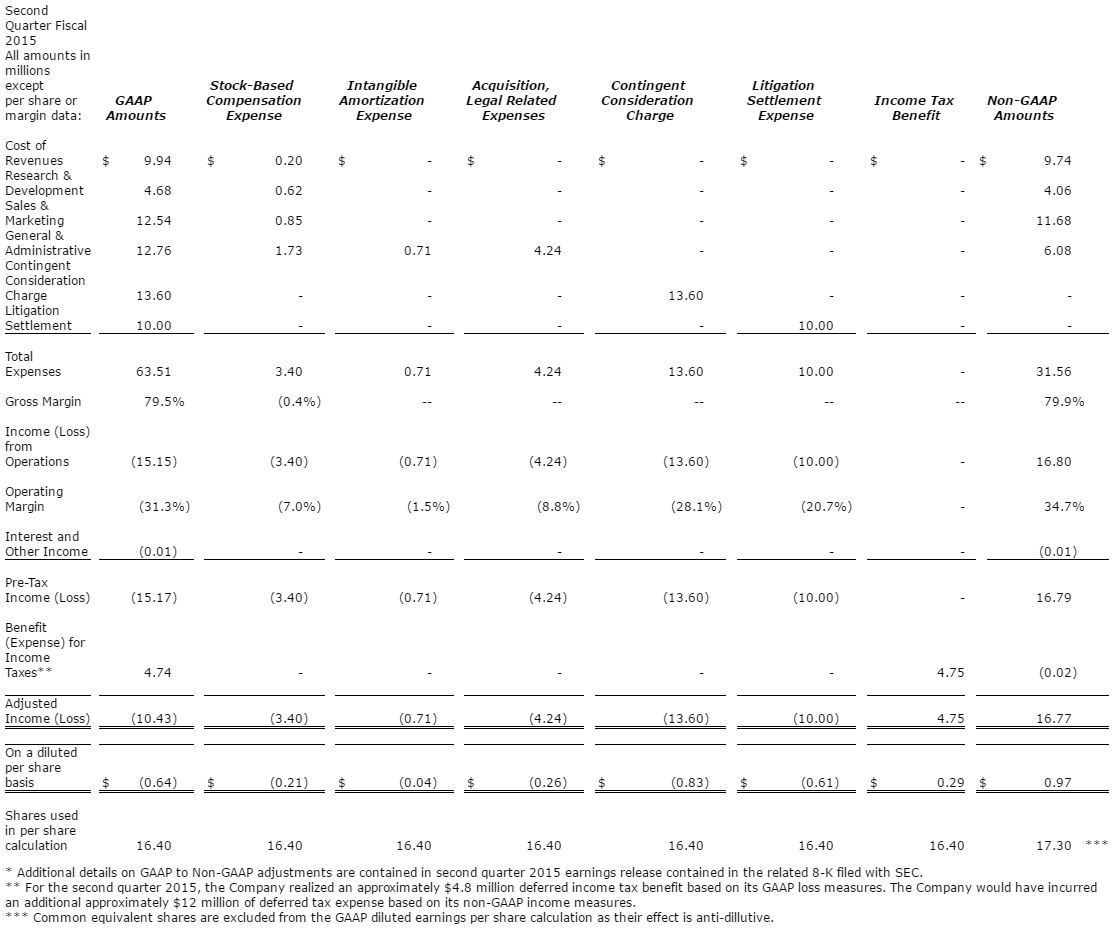

Excluding the stock-based compensation expense, intangible amortization expense and acquisition related expense, non‑GAAP income from operations was $37.1 million. Also excluding amortization of capitalized debt issuance costs and non‑cash income tax expense, non‑GAAP adjusted income was $35.3 million or $1.94 per share based on 18.2 million fully diluted shares outstanding. This compares to second quarter 2015 non‑GAAP income from operations of $16.8 million and non‑GAAP adjusted income of $16.8 million or $0.97 per share based on fully diluted shares outstanding of 17.3 million. Therefore, second quarter non‑GAAP operating income, non‑GAAP adjusted income and non‑GAAP adjusted income per fully diluted share increased by 121%, 111% and 100% year-over-year, respectively.

Second quarter 2016 adjusted EBITDA was $38.2 million which was up 116% compared to $17.7 million in the second quarter of 2015. Second quarter adjusted EBITDA margin was 45.5%, up compared to 36.6% in the second quarter of 2015.

The following tables are provided to facilitate reconciliation of GAAP to Non‑GAAP financial measures:

Reconciliation of GAAP to Non‑GAAP Financial Measures

Reconciliation of GAAP to Non‑GAAP Financial Measures (Second Quarter 2015)*

Reconciliation of GAAP Net Income to Adjusted EBITDA

Taxes

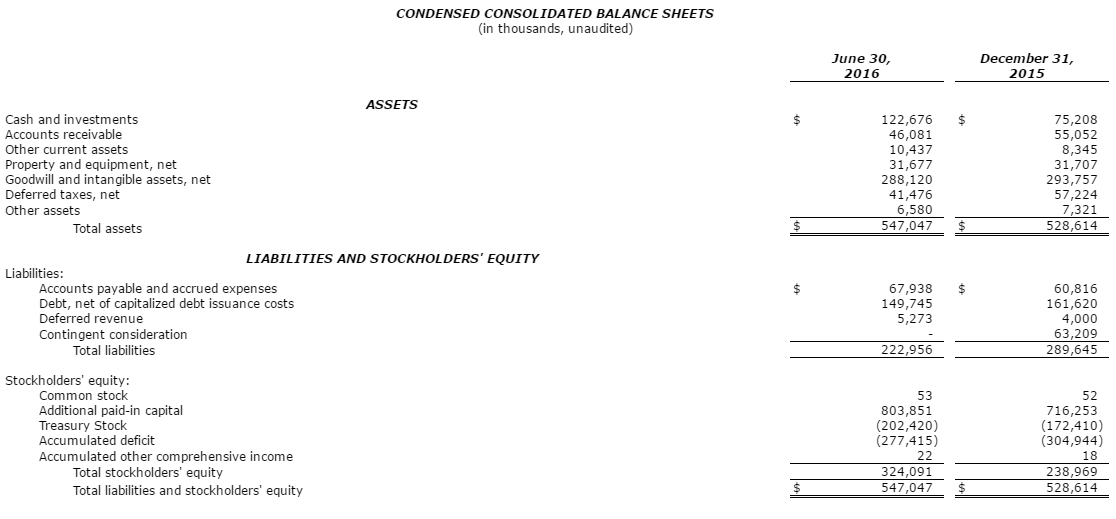

As of June 30, 2016, the Company had a $41 million deferred tax asset resulting from past net operating losses and other tax credits. For the second quarter of 2016, the Company reported a GAAP income tax expense of $9.8 million which was composed of a cash income tax expense of $1.1 million and a non‑cash income tax expense of $8.7 million. The Company expects to be able to continue to utilize its deferred tax assets to reduce cash taxes for the remainder of 2016.

Share Repurchase and Debt Repayment

During the second quarter of 2016, the Company repurchased approximately 305 thousand shares at a total cost of approximately $26.6 million. On July 27, 2016, the Board of Directors approved a share repurchase program that authorized the Company to repurchase up to $40 million of shares of stock through January 2017.

During the second quarter, we made principal repayments of $11 million against the borrowings under the Company’s existing credit agreement related to the Endicia acquisition. As of June 30, 2016, the total debt under the credit agreement excluding capitalized debt issuance costs was $151.4 million.

Business Outlook

For 2016, the Company currently estimates revenue to be in a range of $320 to $345 million; this compares to previous guidance of $310 to $330 million. GAAP net income per fully diluted share is expected to be in a range of $2.50 to $3.00. GAAP net income per fully diluted share includes approximately $35 million of stock based compensation expense, approximately $15 to $18 million of acquired intangibles and debt issuance cost amortization expense, approximately $1 million of acquisition related expense and approximately $30 to $35 million of non‑cash tax expense. Excluding the stock-based compensation expense, the amortization expense of acquired intangibles and debt issuance costs, the acquisition related expense and non‑cash income tax expense, non‑GAAP adjusted income per fully diluted share is expected to be in a range of $7.00 to $7.50; this compares to previous guidance of $6.00 to $6.50 per fully diluted share. This business outlook does not include the impact from potential future acquisitions, including acquisition costs or related financings, or unanticipated events. This business outlook and the related assumptions are forward looking statements subject to the safe harbor statement contained at the end of this press release.

Company Customer Metrics and Conference Call

A complete set of the quarterly customer metrics for the past three fiscal years is available at http://investor.stamps.com (under a tab on the left side called Company Information, Metrics).

The Stamps.com financial results conference call will be webcast today at 5:00 p.m. Eastern Time and may be accessed at http://investor.stamps.com. The Company plans to discuss its business outlook during the conference call. Following the conclusion of the webcast, a replay of the call will be available at the same website.

About Stamps.com, Endicia, ShipStation, ShipWorks and ShippingEasy

Stamps.com (NASDAQ: STMP) is the leading provider of postage online and shipping software solutions to approximately 650,000 customers, including consumers, small businesses, e‑commerce shippers, enterprises, and high volume shippers. Stamps.com offers solutions that help businesses run their shipping operations more smoothly and function more successfully under the brand names Stamps.com, Endicia, ShipStation, ShippingEasy and ShipWorks. Stamps.com’s family of brands provides seamless access to mailing and shipping services through integrations with more than 400 unique partner applications.

ShipStation is a leading web-based shipping solution that helps eCommerce retailers import, organize, process, package, and ship their orders quickly and easily from any web browser. ShipStation features the most integrations of any eCommerce web-based solution with more than 100 shopping carts, marketplaces, package carriers, and fulfillment services. Integration partners include eBay, PayPal, Amazon, Etsy, Square, Shopify, BigCommerce, Volusion, Magento, Squarespace, and carriers such as USPS, UPS, FedEx and DHL. ShipStation has sophisticated automation features such as automated order importing, custom hierarchical rules, product profiles, and fulfillment solutions that enable its customers to complete their orders, wherever they sell, and however they ship.

ShipWorks is the leading client-based shipping solution that helps high volume shippers import, organize, process, fulfill, and ship their orders quickly and easily from any standard PC. With integrations to more than 90 shopping carts, marketplaces, package carriers, and fulfillment services, ShipWorks has the most integrations of any high-volume client shipping solution. Package carriers include USPS, UPS, FedEx, DHL, OnTrac and many more. Marketplace and shopping cart integrations include eBay, PayPal, Amazon, Etsy, Shopify, BigCommerce, Volusion, Channel Advisor, Magento, and many more. ShipWorks has sophisticated automation features such as a custom rules engine, automated order importing, automatic product profile detection, and fulfillment automation, which enable high volume shippers to complete their orders quickly and efficiently.

ShippingEasy is a leading web-based shipping software solution that allows online retailers and eCommerce merchants to organize, process, fulfill and ship their orders quickly and easily. ShippingEasy integrates with leading marketplaces, shopping carts, and eCommerce platforms to allow order fulfillment and tracking data to populate in real time across all systems. The ShippingEasy software downloads orders from all selling channels and automatically maps custom shipping preferences, rates and delivery options across all supported carriers.

About Non‑GAAP Financial Measures

To supplement the Company’s condensed consolidated financial statements presented in accordance with GAAP, Stamps.com uses non‑GAAP measures of certain components of financial performance. These non‑GAAP measures include non‑GAAP income from operations, adjusted EBITDA, non‑GAAP pre-tax income, non‑GAAP adjusted income, non‑GAAP adjusted income per fully diluted share, non‑GAAP EPS calculated as non‑GAAP adjusted income divided by fully diluted shares, non‑GAAP gross margin, non‑GAAP operating margin and adjusted EBITDA margin. Adjusted EBITDA as calculated in this release represents earnings before interest and other expense, net, interest and other income, net, income tax expense, income tax benefit, depreciation and amortization and incorporates certain items described in this release used to reconcile GAAP to non‑GAAP financial measures. Adjusted EBITDA margin is calculated as adjusted EBITDA divided by total revenue for the period. Reconciliation to the nearest GAAP measures of all non‑GAAP financial measures included in this press release can be found in the financial tables of this earnings release.

Non‑GAAP measures are provided to enhance investors’ overall understanding of the Company’s financial performance, prospects for the future and as a means to evaluate period-to-period comparisons. The Company believes that these non‑GAAP measures provide meaningful supplemental information regarding financial performance by excluding certain expenses and benefits that may not be indicative of recurring core business operating results. The Company believes the non‑GAAP measures that exclude certain non‑cash items such as stock-based compensation, amortization of acquired intangibles and capitalized debt issuance costs, contingent consideration charges and income tax adjustments, and certain expenses such as acquisition related expenses and litigation settlement expenses, when viewed with GAAP results and the accompanying reconciliation, enhance the comparability of results against prior periods and allow for greater transparency of financial results. The Company believes non‑GAAP financial measures facilitate management’s internal comparison of the Company’s financial performance to that of prior periods as well as trend analysis for budgeting and planning purposes. The presentation of non‑GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

Share Repurchase Timing

The timing of share repurchases, if any, and the number of shares to be bought at any one time will depend on market conditions, the Company’s compliance with the covenants in its Credit Agreement and the Company’s assessment of the risk that its net operating loss asset could be impaired if such repurchases were undertaken. Share repurchases may be made from time-to-time on the open market or in negotiated transactions at the Company’s discretion in compliance with Rule 10b-18 of the United States Securities and Exchange Commission. The Company’s purchase of any of its shares may be subject to limitations imposed on such purchases by applicable securities laws and regulations and the rules of the Nasdaq Stock Market.

“Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: This release includes forward-looking statements about anticipated results which involve risks and uncertainties. Important factors, including the Company’s ability to successfully integrate and realize the benefits of its past or future strategic acquisitions or investments, including its acquisition of Endicia and ShippingEasy, complete and ship its products, maintain desirable economics for its products, the timing of when the Company will utilize its deferred tax assets, and obtain or maintain regulatory approval, which could cause actual results to differ materially from those in the forward-looking statements, are detailed in filings with the Securities and Exchange Commission made from time to time by STAMPS.COM, including its Annual Report on Form 10-K for the year ended December 31, 2015, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. STAMPS.COM undertakes no obligation to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Stamps.com, the Stamps.com logo, Endicia, ShipStation, ShipWorks, and ShippingEasy are trademarks or registered trademarks of Stamps.com Inc. and its subsidiaries. All other brands and names are property of their respective owners.

Investor Contact:

Jeff Carberry

Stamps.com Investor Relations

(310) 482-5830

[email protected]

Press Contact:

Eric Nash

Stamps.com Public Relations

(310) 482-5942

[email protected]